The sustainable management of Australian Farmlands Funds’ diverse agricultural and water portfolio focuses on regenerative practices and sustainable use of resources in the face of climate-related risks. The product of these practices is evident in the Fund’s leadership in water-use efficiency at the nexus of the land and water portfolios.

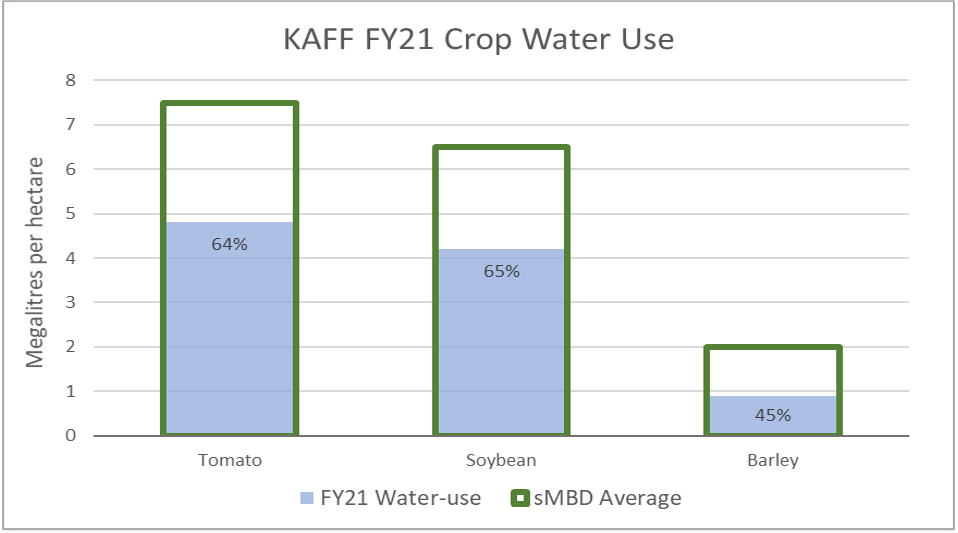

Crops grown over FY21 at KAFF have shown some impressive results when it comes to water efficiency. Tomatoes consumed 4.8ML/ha, which was an impressive 36% below the long-term average water use for processing tomatoes in the southern Murray-Darling Basin (sMBD), and an improvement on last year’s crop, which was 9% below average. These figures show how careful water efficiency management can influence the farmlands water consumption. For tomatoes in FY21, a less water-intensive variety was grown, and harvest begun earlier, saving some late irrigation applications. In addition, the significant mid-2020 rains were used to the advantage of preparing the fields for transplant.

There were also impressive results with the newly established soybean and barley crops, the respective crops’ water-use being 35% and 55% below long-term averages in the sMBD. In addition, a cover crop was established over winter before the sowing of the soybeans, leading to much higher moisture retention in the soil and less irrigation required post-sowing. The barley crop benefited significantly from the above-mentioned mid-2020 rainfalls, leading to an exceptionally low irrigation volume compared to the regional average.

Leadership in water-use efficiency forms a key aspect of the KAFF ESG strategy, with annual ESG reports tracking and monitoring the Fund’s water use. Guided by the long-term goal of each crop’s water use, consistently reaching targets of 10% below the long-term averages in the southern Murray-Darling Basin. For more information on the Funds’ water use goals and outcomes, see the annual ESG report here.