The Australian Farmlands Fund is proud to support the launch of Responsible Investment Association Australasia’s (RIAA) Annual Responsible Investment Benchmark Report this month. The Funds have been actively involved with RIAA since inception, and are certified by RIAA’s Responsible Investment program. As one of the leading impact investors in Australian agriculture, Kilter closely monitors the performance of KAFF and how the Funds align with broader expectations in impact investing. Having previously been identified as an exceptional case study in RIAA’s Impact Investing Performance Report in 2020, Kilter is encouraged to see the growth of the impact investing industry in Australasia.

This year’s benchmark report outlines the performance of Australia’s responsible investment (RI) market in 2020, and compares the RI industry to the broader financial market. Based on the performance and details of 198 responsible investment managers, the RI benchmark report highlights what the current trends are in impact funds, and where the industry is heading. RI funds are shown to be growing as a share of the market and growing in popularity, with volume of AUM under responsible investor leaders growing by 30% in 2020, now holding 40% of the total managed funds in Australia. While the total number of investment managers in Australia engaging in responsible investment practices grew by 20% from 2019 to 2020.

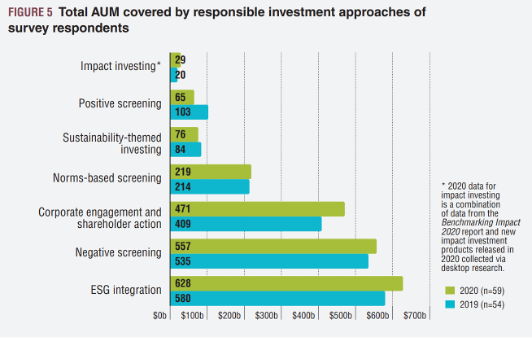

The above figure, extracted from the Benchmark Report, highlights the various RI approaches taken by the financial market. Impact Investing (defined as investing to achieve positive ESG impacts and being measured and monitored against these) grew significantly as a RI approach, increasing by 46%. Yet adoption of impact investing remains lower than the six other RI approaches defined in RIAA’s RI spectrum. ESG integration was the most prevalent RI approach in 2020, covering a total of $628 billion AUM. The growth of AUM subject to RI approaches, along with the continued outperformance of responsible investments in multi-sector funds, paints a positive picture for the RI industry going forward.

While impact investing remains the niche top-tier investment strategy in the broader RI market, it is promising to see its growth in AUM and wider popularity. Kilter is proud to be on the leading edge of impact investing in Australasia, and we are looking forward to more players in the RI market aiming for best practice. For more information and a deeper insight into the future of responsible investment, find the full report on RIAA’s website here: https://responsibleinvestment.org/resources/benchmark-report/